Our multidisciplinary team provides a range of planning, compliance, audit defense, and benchmarking services. In all cases, our professionals work to develop transfer pricing policies that are defensible, flexible, and in line with our clients’ overall tax planning strategies.

Legal framework

- The Standard Fiscal Control File (SAF-T) is an international standard for the electronic exchange of accounting data between Companies and tax authorities and auditors based on the SAF-T 2.0 version designed by the Organization for Economic Cooperation and Development.

- SAF-T is an electronic, XML-based file containing accounting data extracted from taxpayer accounting systems, the data being exported and stored in a standardized format.

- Among the objectives of the SAF-T implementation we find the reduction of the cost of compliance for companies, the reduction of the time allocated to a tax inspection, a greater transparency of the control act, the simplification or even the elimination of some declarations in the future.

Instructions and documentation

- The form, the assistance program and the necessary instructions/documentation are made available to taxpayers by the National Fiscal Administration Agency and can be downloaded from the ANAF website at www.anaf.ro.

- BDO consultants can help you navigate the process and the ANAF relationship

Preparation of the statement

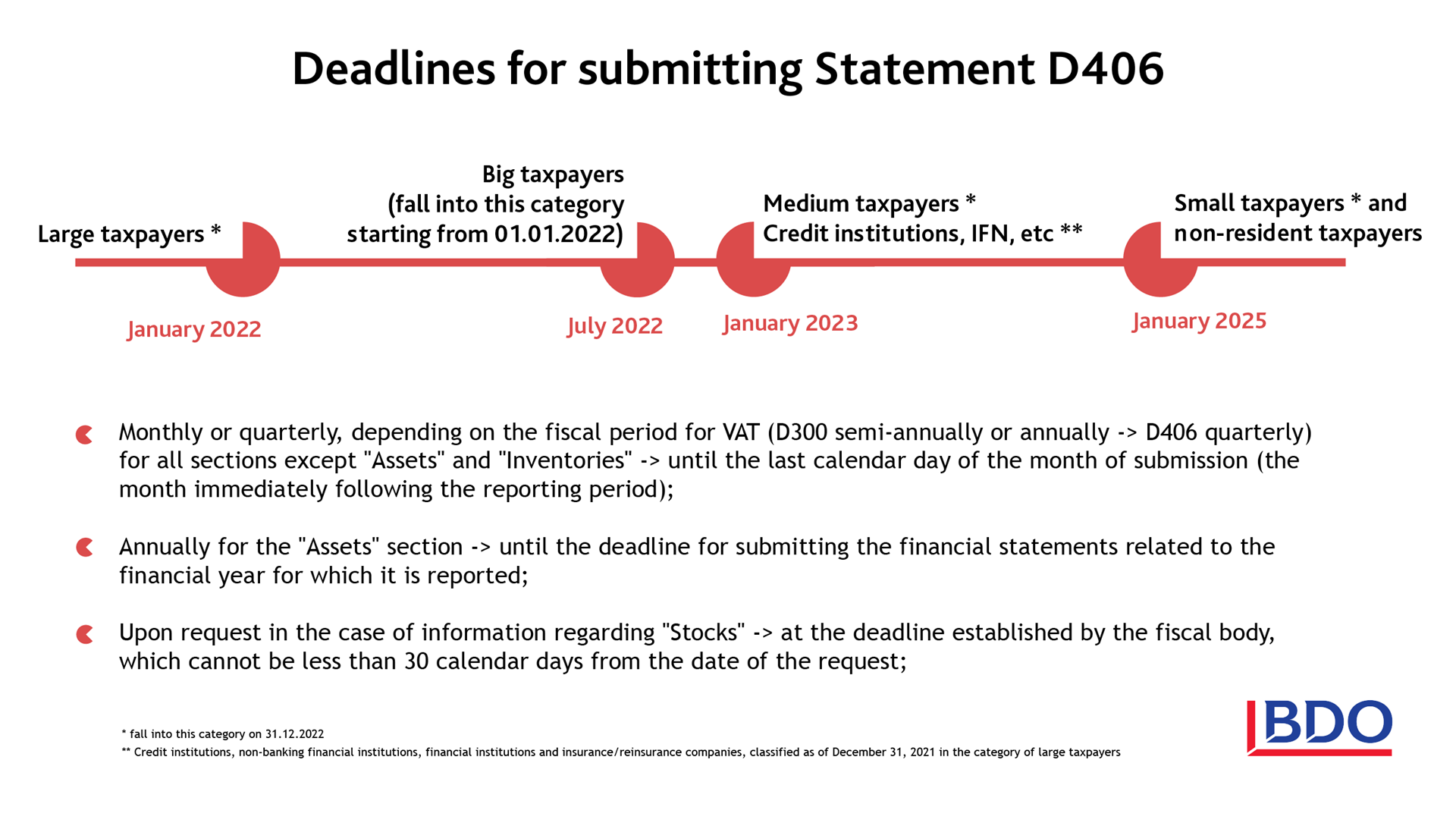

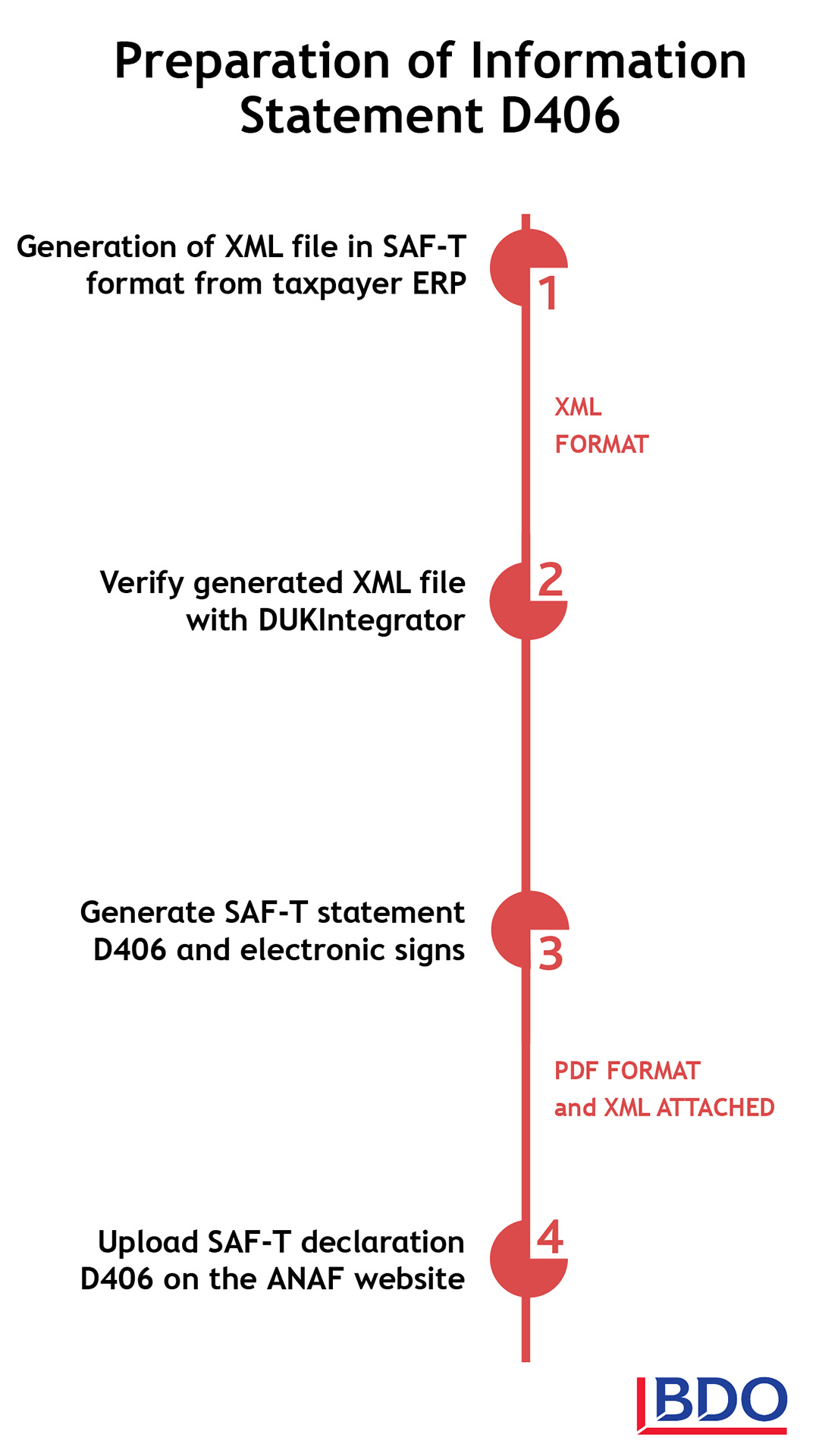

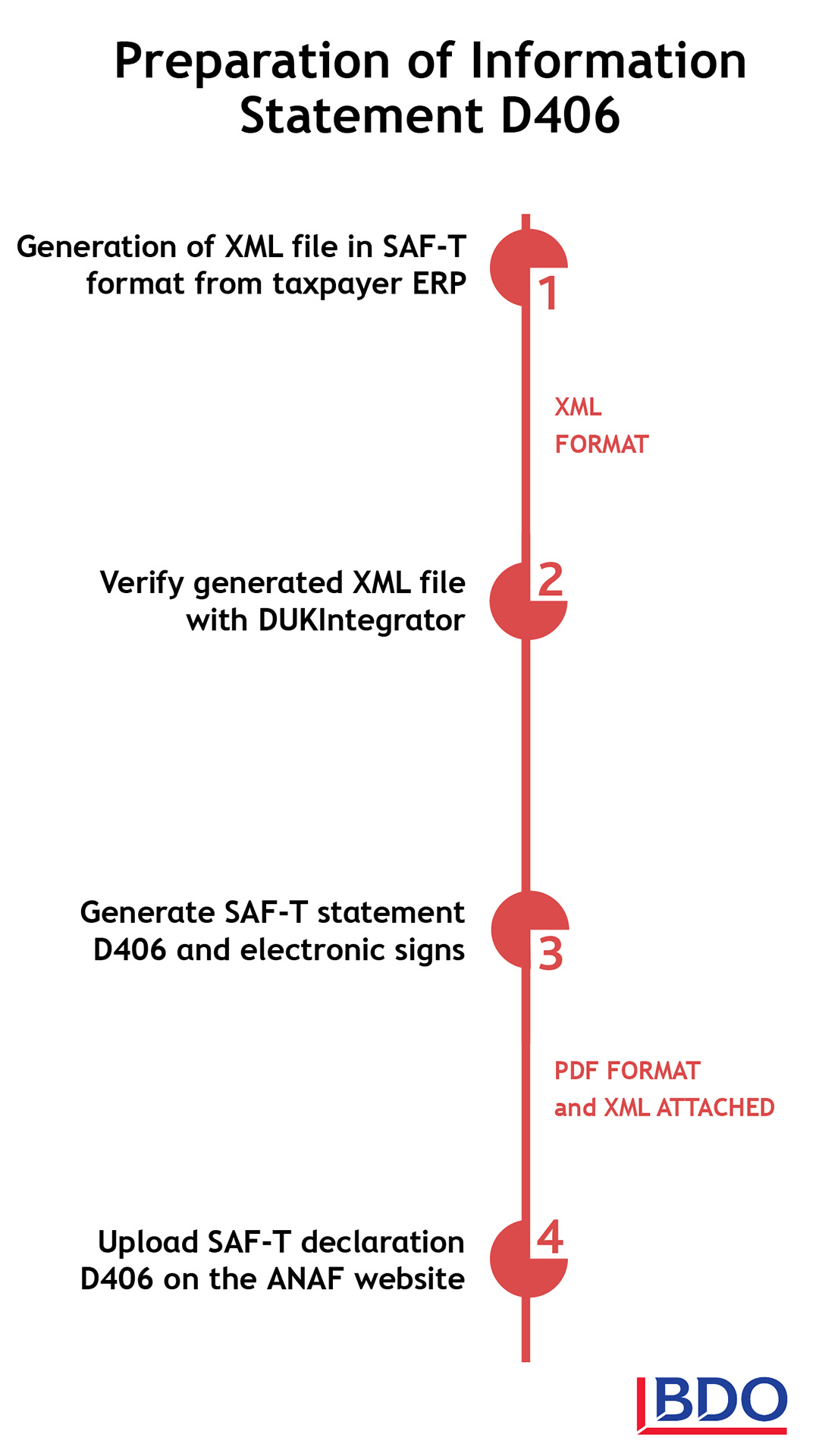

The preparation of the D406 Informative Statement is carried out as follows:

- Generation of the XML file according to the specifications of the SAF-T Scheme for Romania using the taxpayer's own IT applications and based on data from the taxpayer's accounting, fiscal and management records;

- Verification of the structure of the XML file and some correlations between data through the Validator Soft J computer program made available by ANAF, in the form of the Support Program;

- Generation of the Informative Declaration D406 as an electronic document in PDF format with attached XML (if it has met the verification conditions) and signed electronically with the qualified digital signature of the taxpayer or his fiscal representative.

The BDO consultants are ready to offer you the best solutions.